- #9 21 ema strategy how to

- #9 21 ema strategy code

Take profit: Traders can set a take profit level, which is the level at which the trade will be closed if it reaches a certain amount of profit.Īdvantages and Disadvantages of the 9 EMA Trading StrategyĪdvantages of the 9 EMA Trading Strategy:. We believe the only Holy Grail trading strategy is diversification. Diversification: Diversifying a portfolio by spreading risk across multiple financial instruments and markets can help offset losses if one market or instrument underperforms. Position sizing: Traders can limit their risk by controlling the size of their trades based on their account balance and risk tolerance. However, we are very skeptical of using stop loss orders, read here for why you should use alternatives to a stop loss. Stop loss orders: Traders can set stop loss orders at a certain level below the entry price to limit potential losses if the trade goes against them. Risk Management Strategies for the 9 EMA Trading Strategy Go live with a small amount: Start with a small account and gradually grow the account.

We recommend putting the strategy in “incubation” for at least 12 months before you commit real money. Forward -test with a demo account: If it is a scalping or intraday strategy that can be tested in a short time, trade it on a demo account first.Backtest your strategy: Test the strategy on historical data to know how it would have performed in the past.

#9 21 ema strategy code

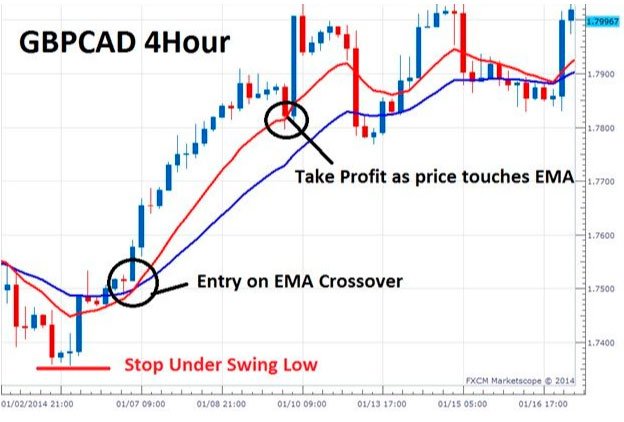

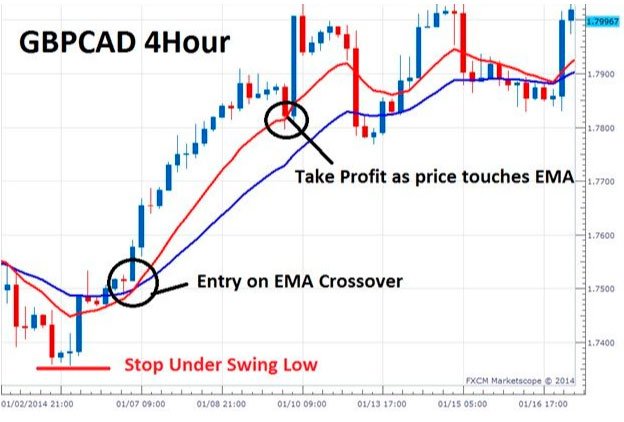

Create your strategy rules: Code your strategy and specify the rules for buying and selling the security. Select Security: Decide which security you want to trade, like stocks, futures, options, or currencies. Steps to Implement the 9 EMA Trading Strategy Risk management strategy: This would include position sizing and stop-loss orders. Buy and Sell Signals: It generates buy signals when the price of a given security is above the 9 EMA, and sell signals when the price is below. The indicator: The strategy uses the 9- period Exponential Moving Average (EMA), which can identify the short-term trends in the market. Key Components of the 9 EMA Trading Strategy The 9 EMA can be easily tweaked and used in conjunction with other technical indicators for optimum performance. The 9 EMA is a simple indicator that can be used to trade any financial security. It can help traders to spot trend changes in the market easily. Benefits of the 9 EMA Trading StrategyĪ moving average can be a useful tool for a trader: The chart above in Bitcoin shows the 9-day EMA in red and green arrows show when the close crosses above the EMA line, and the red arrows show when the close crosses below. The strategy can be applied to several securities, such as forex, stocks, and commodities. In this strategy, a buy signal is generated when the price of a security moves above the 9 EMA, and a sell signal is generated when the price moves below the 9 EMA. EMA gives more weight to the recent prices, which can help traders to accurately identify market swings. It uses 9-EMA to identify short-term market swings in the price of a security. The 9-EMA strategy is a technical analysis strategy that uses the 9-day exponential moving average (EMA) to generate buy and sell signals for trading securities. Introduction to the 9 EMA Trading Strategy 9 EMA strategy backtest – does it work?. What Are the Most Popular Variations of the 9 EMA Strategy?. What Types of Markets Can the 9 EMA Strategy Be Used In?. #9 21 ema strategy how to

How to Combine the 9 EMA Strategy with Other Trading Strategies.

What Indicators Can Be Used in Conjunction with the 9 EMA Strategy?. How to Identify the Best Entries and Exits Using the 9 EMA Strategy. Tips to Optimize the 9 EMA Trading Strategy. How to Use the 9 EMA Strategy to Reduce Risk. Common Mistakes to Avoid When Implementing the 9 EMA Strategy. Examples of Profitable Trades Using the 9 EMA Strategy. Advantages and Disadvantages of the 9 EMA Trading Strategy. Risk Management Strategies for the 9 EMA Trading Strategy. Steps to Implement the 9 EMA Trading Strategy.

What Indicators Can Be Used in Conjunction with the 9 EMA Strategy?. How to Identify the Best Entries and Exits Using the 9 EMA Strategy. Tips to Optimize the 9 EMA Trading Strategy. How to Use the 9 EMA Strategy to Reduce Risk. Common Mistakes to Avoid When Implementing the 9 EMA Strategy. Examples of Profitable Trades Using the 9 EMA Strategy. Advantages and Disadvantages of the 9 EMA Trading Strategy. Risk Management Strategies for the 9 EMA Trading Strategy. Steps to Implement the 9 EMA Trading Strategy.

Key Components of the 9 EMA Trading Strategy.Introduction to the 9 EMA Trading Strategy.

0 kommentar(er)

0 kommentar(er)